When it comes to gauging the user experience of a product, the concept of viability of the product is well known. If the product gives enough value to address the core problem statement and expectations of the target users, the product manager tends to release the product in a shape which is widely known as a minimal viable product, or an MVP. It is a time tested successful practice of releasing an MVP as opposed to waiting for a more detailed product, as it gives the product manager an option to test the product performance on live users and thereby channelize the future enhancement efforts in the right direction based on user feedback.

Just like the user experience and the value proposition offered by the product, the business viability of the product is equally important. Measuring this business viability at detailed granular levels gives that much understanding of the gains vs the expenses equation inherent in building and distributing the product. Let’s attempt to understand this for consumer Internet products.

Contribution Analysis

Revenue is directly proportional to the users served. In manufacturing industries, this can further be measured in terms of the volume of the product being manufactured, so that unit selling price and unit production cost can be measured to calculate business viability. To a large extent in consumer Internet industry though, like services industries, there’s no concept of unit of product. So the viability is calculated at user level itself.

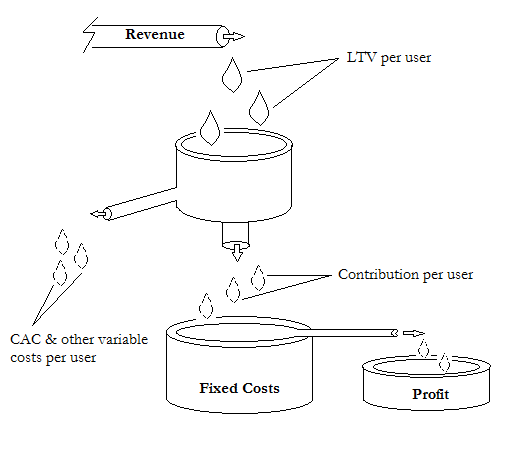

The following simple diagram attempts to find the relation between users served and the business viability [1].

- LTV per user: LTV, or Life Time Value for a user is the revenue expected from a user over a calculation period. This period can be as small as a quarter, or as big as a year. Whatever be the period, the same period needs to be considered for cost items too. E.g. LTV for a subscription product will be the subscription amount, for an ad based content product it will be the ad revenue generated per user, for an eCommerce product it will be the gross revenue generated per user, and so on.

- CAC & other variable costs per user: CAC, or Customer Acquisition Cost is the cost per user required to acquire the user to become a customer for your product. E.g. the marketing campaigns for bringing traffic to web, or for app installation, or monetary incentive given for referral, all such costs calculated at per user level will be CAC. In addition, the product might have other costs to serve a user. E.g. in eCommerce, the order fulfilment and delivery charges have a variable component that depends on each order, and thus, on each user.

- Contribution per user: Continuing from above, the contribution per user will now simply be the difference between the LTV and all the variable costs per user. This is what one user contributes towards the top line of the product’s business.

- Fixed costs: In addition to variable costs per user, running the business would have several fixed costs too. E.g. the cost of acquiring and producing the content for a content product, establishing fulfilment centers and logistics networks for an eCommerce product, etc. Some of the other costs might appear variable, i.e. they increase as the user base increases, but even they might have a fixed component in the form of minimum commitment. E.g. tech infra setup cost. The relation between contribution and fixed costs is the key to determine the product’s business viability, as the contribution per user is always towards addressing the fixed costs. Thus the number of users needed to generate a total contribution equal to the fixed costs is the break even point for the product.

- Profit: Simply put, whatever trickles in excess once the fixed costs are completely met, becomes the gross profit for the business.

The above explanation is an overtly simplistic one, and doesn’t take into account other factors in establishing the business, like interest on liabilities, taxes, or any depreciation or amortization. But it serves to understand the basic relationship among revenue generated per user, variable costs per user, thus the contribution per user, and finally the contribution towards fixed costs first, and profit only later.

As a product manager, having this basic understanding to measure the business viability for your product might go a long way. This can help one understand why starting up few consumer Internet businesses is easier pertaining to low fixed costs, e.g. online payments products in finTech, but very important to scale too for business viability, pertaining to low contribution per user. While thinking about building features for your product, have an overall sense of the impact on the above mentioned items. Any feature with positive contribution per user, with minimum addition in fixed costs will increase the overall business viability.

[1] This illustration is inspired from a similar one from the book “Accounting: Text & Cases”, which covers financial and management accounting concepts.